Hi guys I hope everybody is having a good week unfortunately I'm a little under the weather today I'm just kind of a little sickly and blood kind of dying, but I just want to give you guys a little update and let you know what is new with me and everything I've been getting a lot of questions from people asking if I've heard anything yet if I've got my newest appointment yet and the answer is no not, yet I won't know anything like I said in my past video until like June or July, so I'm kind of in that awkward in-between phase where I just kind of have to wait it out, and I don't really have much choice so yeah unfortunately, so I'm just trying to hang in there everything right now I'm just kind of trying to take care of myself because a couple last couple days I've been feeling a little sickly a little gross so excuse myself for being so pale you know I'm pale normally anyway but no extra pale but yeah so I just kind of have to sit back relax and wait it out now I've also had a lot of questions about the US residency certificate and how to fill it out I would make a video about that, but the only thing is that there's a lot to it, so I figured it'd just be easier for me to just type everything out any helpful tips I had or just kind of like deciphering the IRS lingo that they have in those instructions because I know is a pain in the butt I know it is I've been there I've been through it, I promise you will get through it too, so you could go to my...

Award-winning PDF software

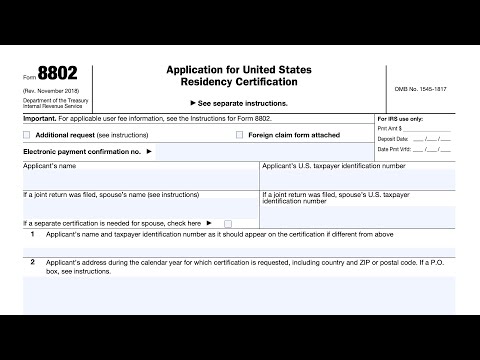

How to prepare Form 8802

About Form 8802

Form 8802, also known as Application for United States Residency Certification, is a document used by individuals or entities to request a certificate of residency from the United States Internal Revenue Service (IRS). The purpose of this form is to establish the withholding tax status of the applicant in the United States for tax purposes. The certificate of residency, once approved by the IRS, can be presented to foreign countries as evidence that the applicant is a resident of the United States and is therefore eligible for tax benefits or relief under applicable tax treaties. Various entities and individuals may need to file Form 8802, including but not limited to: 1. Individual taxpayers: U.S. citizens or resident aliens who need to claim tax benefits or relief on income earned abroad. 2. Foreign entities: Entities incorporated or conducting business outside the United States that require proof of U.S. residency for tax purposes. 3. Entities with U.S. partners: Foreign partnerships, corporations, estates, or trusts with U.S. partners or beneficiaries seeking to establish their U.S. residency status. 4. Artists, athletes, or entertainers: Non-U.S. residents earning income from performances or events that have tax implications in the United States. 5. Investors or businesses: Non-U.S. investors or businesses with U.S. investments seeking to avail tax benefits or treaty provisions related to withholding taxes. It is important to note that the process of obtaining a certificate of residency through Form 8802 can be complex, and applicants should carefully follow the guidelines provided by the IRS to ensure accurate and timely submission.

What Is Form 8802?

The 8802 Form is used by the individuals who want to get treaty benefits for federal taxes. It shows the person’s residency status. The US citizen should complete and send the request to at least in forty-five days before submitting 6166 Form. It will prevent delays in the application processing and fasten the answer for it. As every sample, it requires not only correct and up-to-date information to be provided, but also the fee to be paid. The payment bills should be attached to the template and sent together with it.

Submit the sample electronically in PDF on our website and save it to the internal storage of your device in several simple steps. The online-based solution uses the newest data transcription methods to protect all the important data your document may contain.

Complete Irs 8802 Form Electronically in PDF

First of all, prepare the originals of the supporting documents. They are the US identification and residence proofs, like the identification card; permanent resident card, visa or additional papers. Next, click at “Start Now” button and the 8802 Form blank will be opened in the editor automatically. Basically, every customer should mention the following details:

- Start with electronic payment confirmation number and indicate your personal information such as a name, your and your spouse taxpayer identification number.

- Include the postal address you will have during the calendar year, phone number and specify your status as a citizen, lawful permanent resident or alien citizen with a visa. Select the item applicable to you.

- Specify the type of corporation you have to specify whether it is located in the United States or another country.

- Prthe years you require the certification for.

- Add a digital signature using the signature wizard. Type in your full name and select the desired style or draw a signature.

Save the Form 8802 with “DONE” button and download it to the internal storage of your device. Finally, you get a completed digital template, that can be reused several times. Print the document on paper or send its electronic version to by e-mail.

Online choices enable you to arrange your doc management and enhance the productiveness of one's workflow. Stick to the short guide as a way to finished Form 8802, avoid problems and furnish it in the timely fashion:

How to finish a Irs Form 8802?

- On the website together with the form, click Start out Now and pass towards the editor.

- Use the clues to fill out the appropriate fields.

- Include your individual data and phone facts.

- Make absolutely sure that you enter correct details and numbers in proper fields.

- Carefully look at the material within the form likewise as grammar and spelling.

- Refer to help you part if you've got any questions or tackle our Guidance group.

- Put an electronic signature on your Form 8802 aided by the enable of Indication Tool.

- Once the form is accomplished, press Done.

- Distribute the all set sort via e mail or fax, print it out or save with your product.

PDF editor allows for you to make modifications in your Form 8802 from any online world related system, personalize it in line with your requirements, signal it electronically and distribute in numerous means.

What people say about us

How you can fill in forms without having mistakes

Video instructions and help with filling out and completing Form 8802